One-Stop-Shop is in place! Test now whether OSS is also relevant for you!

With our test you will find out what the One-Stop-Shop (OSS) means for your company and whether you are affected.

Start the testRecommended for sellers on

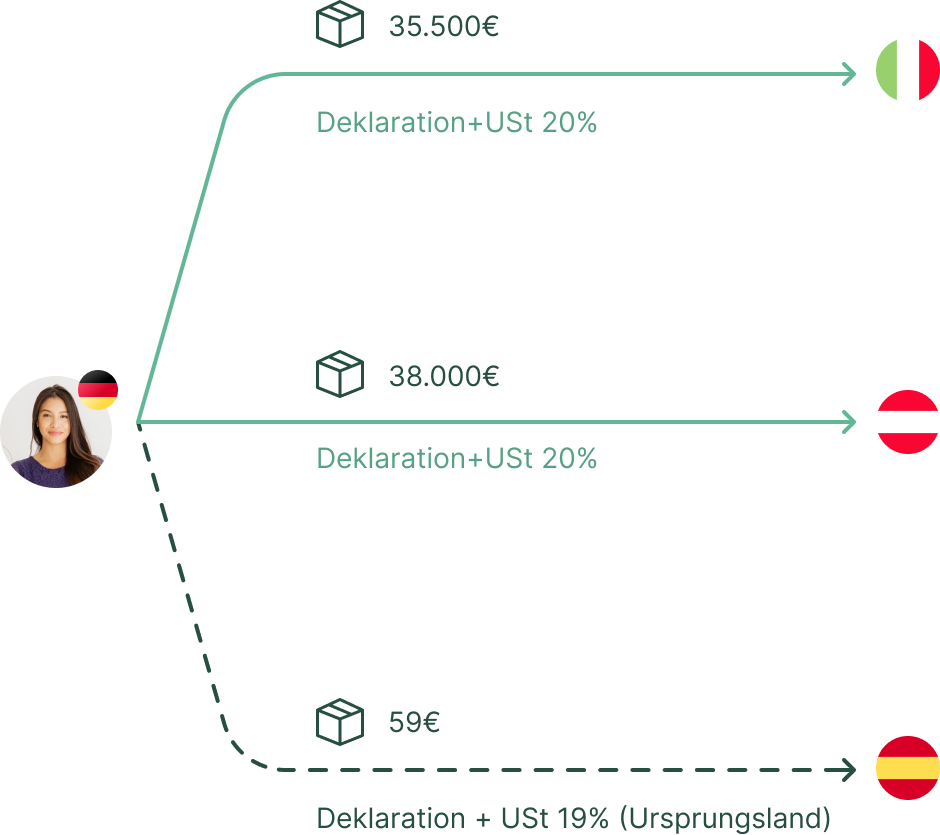

If you opt for the One-Stop-Shop: how does it work?

One-Stop-Shop

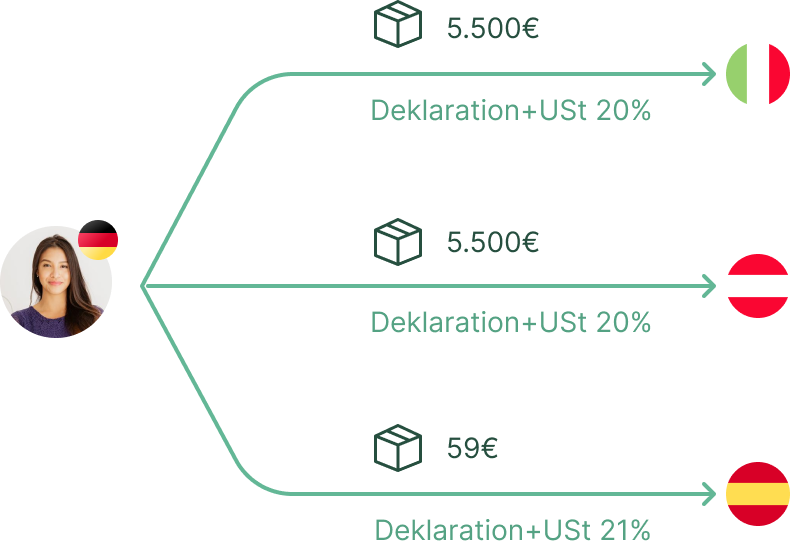

This is the fundamental sales tax reform for

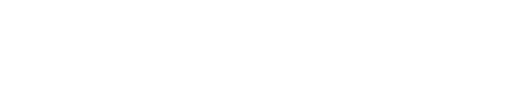

E-commerce sellers. Instead of national delivery thresholds, an EU-wide delivery threshold of €10,000 comes into force. If the delivery threshold is exceeded, the taxable online retailer declares in an electronic tax return to the OSS what sales he has achieved with distance sales to B2C customers in countries that do not correspond to his company headquarters.

Legal text • 30 Min.

Legal text • 30 Min.

Legal text • 30 Min.

Legal text • 30 Min.Risks without One-Stop-Shop

Register OSS with countX in a few steps

Don't waste your time on legal texts.

We take over OSS for you.

countX is your partner in e-commerce for everything related to sales tax. Automation and experience in one package.

Customers about countX

We have been working with the team behind countX for many years. They have always solved our problems, provide expert personal support and automate with technology.

countX represents me reliably in terms of sales tax in several EU countries. The processes were transparent from the start, and the team can be reached at any time with competent feedback.